Also the MIRB has closed all its office premises until 14 April 2020 but is providing some limited services. The amount of penalty you will have to pay is as per below.

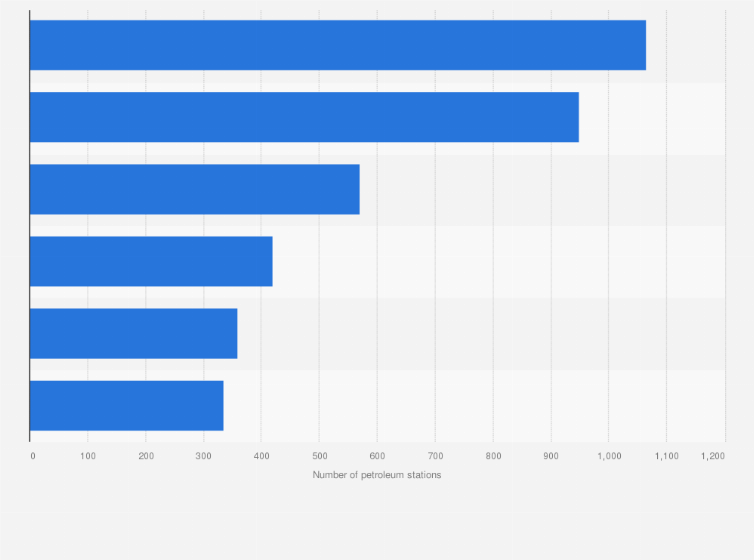

Malaysia Number Of Petroleum Stations By Brand Statista

Dimaklumkan bahawa pembayar cukai yang pertama kali.

. On the First 5000. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. For a person carrying on a business the.

Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year. Besides of declaring your income and reliefs and submitting your tax files before the deadline stipulated by LHDN taxpayers are also responsible for record keeping. On the First 5000 Next 15000.

Grace period is given until 31 October 2017. 30042022 15052022 for e-filing 5. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

The tax filing deadline for person not carrying on a business is by 30 April in the following year. 30062022 15072022 for e-filing 6. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak dikenakan.

The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who do carry on a business. E - Return form of employer employers which are not companies the deadline is March 31 2017. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM.

If this is your first time filing your tax through e-Filing dont worry. Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5.

Under the e-Filing section click on e-Borang which will take you to the e-Filing tax forms. 12 October 2017 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General. Key Malaysian Income Tax Info Do I need to file my income taxYes you would need to file your income tax for this past year if.

Income tax return for individual with business income income other than employment income Deadline. You must contact the IRS at 1-800-829-1040 if you filed a. The deadline to file the 2017 tax return is October 15 2021 if you received an extension.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. 62017 Date Of Publication. BE - Return Form of an individual resident who does not carry on a business the deadline is April 30.

Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month April 30 2020 15 days May 15 2020 15 days July 15 2020 Via postal delivery 3 working days April 3 2020 3 working days May 5 2020 3 working days July 3 2020. Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only. B P - Return Form of an Individual Resident who carries on a business and partnership the deadline is June 30.

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Procedures For Submission Of Real Porperty Gains Tax Form. The tax return is submitted not later than 30 April without business income and 30 June with business income in the following calendar year.

The due date for manual submission of Form E for the year of Remuneration 2016 is on 31 March 2017. INLAND REVENUE BOARD OF MALAYSIA TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No. Income tax return for partnership.

EzHASiL What You Need to Do Make sure youre logged in before you proceed with these steps. Why Have I Not Received My 2017 Tax Refund. Relief other than in respect of error or mistake.

If the company furnished its ITRF on 1 November 2017 the receipt of its ITRF shall be considered late as from 1 October 2017 and penalty shall be imposed under subsection 1123 of. E-filing or online filing of tax returns via the Internet is available for those who wish to file their returns using this method. All the taxpayers are required to keep the following documents for up to 7 years from the end of the year in which the Income Tax Return Form ITRF is filed.

Useful reference information on Malaysian Income Tax 2017 for year of assessment 2016 for resident individuals. Employers which are non-companies are required to use the Malay Language version of Form E CP8-Pin. 1 April 2020 The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis.

Do note that from 17 January 2017 to 5 September 2017 certain services rendered in and outside of Malaysia are still liable to tax. All Income Tax Return Forms must be submitted within 30 days from the date stated on the form or for period that has been set by the government. Team arrived in Malaysia on 142017 to participate in a competition organised.

Income tax return for individual who only received employment income. Effective 1 January 2017 where a taxpayer is not liable to tax and there is an error or a mistake made by him in that return the person may make an application in writing to the DGIR for an amendment to be made in respect of such return within 6 months from the date the tax return is furnished. If you have not received the said Form E by 31 January 2017 Please download and use the Malay language version for submission to IRB.

Microsoft Windows 81 service pack terkini Linux atau Macintosh. The due date for submission of the companys ITRF Form e-C for Year of Assessment 2017 is 30 September 2017.

Malaysia Number Of Petroleum Stations By Brand Statista

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

Thailand Promptpay Transactions Value 2020 Statista

How Do The Income Statement And Balance Sheet Differ

Roundup Of Cloud Computing Forecasts 2017

Pin By Uncle Lim On G Newspaper Ads Best Bond Book Cover Investing

Niche By Students For Students Scholarships For College Scholarships Financial Aid For College

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Free Blank Printable Malaysia Public Holidays 2020 Calendar Printable Calendar Diy Calendar Printables Calendar Holiday Calender

2017 Roundup Of Internet Of Things Forecasts

Mutual Agreement Procedure Statistics For 2017 Oecd

Roundup Of Cloud Computing Forecasts 2017

Do You Need To File A Tax Return In 2018